Who It's For

ArcSyne is for strategists, planners, investors and their advisors facing high-stakes decisions in an uncertain future.

Our use cases to date cover professional services firms focused on private equity and M&A, global multinational brands, alternative investment funds, health care and international development.

Overcome Executive Blindspots

ArcSyne focuses on one problem: overcoming executive blindspots about the near future.

We are honored to be guided by firms in a variety of spaces where solving this problem is valuable, including private equity advisory, law firms, investment funds, multinational brands, and heath services.

Strategy, Planning & Risk Analysis

Strategies that stay resilient in any future.

Plans and budgets that are better “handicapped” and defendable.

Risk scans that detects shifts earlier.

No-regrets playbooks that work in any future.

Board updates that better explain best, base and worst futures, as they unfold.

Client Nurturing in Professional Services

Demand detection that spots new opportunities early.

Prospect nurturing that proves real-time attunement.

Workshops that align to each client’s live landscape.

Recommendations that win across scenarios.

Impact proof that shows value no matter what happens.

Investment and Transaction Support

Due diligence that closes blind spots, fast.

Scenario sets that sharpen exit timing and value.

Portfolio scans that surface macro and corridor exposures.

IC materials that bake in canaries and triggers to improve exit timing.

Deal cycles that align faster and close sooner.

Projects in Development

Tax Preparation and Mobility Services (~$1 Billion)

Helping a private equity advisor brief the CEO on changing needs for international business travel and location services, as a result of new tariff and trade policies.

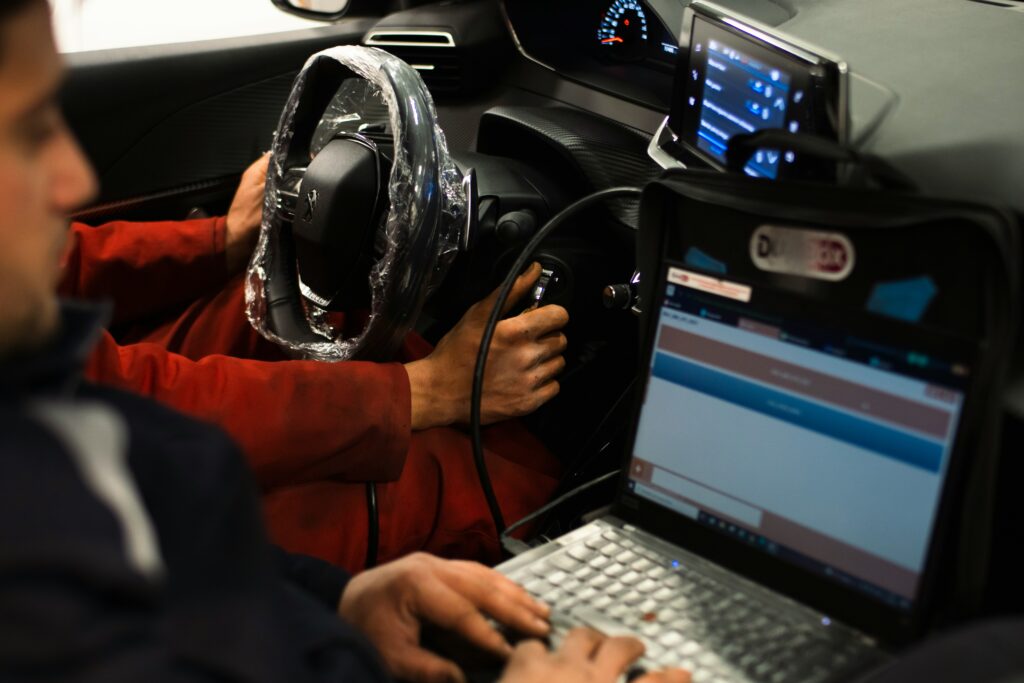

Saas Platform for Automotive Claims Management (~$1 Billion)

Helping a hedge fund portfolio manager identify the contribution of changing consumer claims behavior on the business, as well as the relative importance of this to investors in any demand patterns and investor sentiment scenario.

Global Pharmaceuticals (~$50 Billion)

Helping a global pharmaceutical firm build a “single source of truth” for macro-risks that dynamically update, inform each brand of changing forecast drivers regardless of how scenarios unfold.

Specialty Chemicals (~$450 Million)

Helping a private equity advisor pursue a client engagement to improve performance in any scenario, in light of changing EU and US regulation, tariffs, and new entrants.

Development Agency (Multi-billion fund, U.S. State)

Helping a public-private incubator increase average GDP per inhabitant by prioritizing which sectors to attract, regardless of different policy, federal funding and industrial scenarios.

Event Business for World Economic Forum (<$10 million)

Helping grow a new line of business to organize events facilitating international development dealmaking that will be resilient in any scenario.

Clean Energy Technology (Undisclosed sales; P.E. Fund with $200B AUM)

Providing a private equity fund operating manager with a playbook to support executives on how to overcome go-to-market, pricing and procurement disruption in the wake of the Liberation Day tariffs.

Transform Confusion into Action

Instantly increase strategic acumen, convincing clients, investors, board members and executives of the actions you want to propose.

PoC Offer Gets You Started

Starting at $1499 for Proof of Concept Report

Unique best, worst and base scenarios

No-regrets moves

Playbooks by role and level

Expert human briefing

Upgrade Brings Scenarios to Life

Starting at $4599 for Custom GPT for one month

Dynamic scenarios update with the news

Expert human support

Secure private workspace

Team access